In my previous post, I talked about a few reasons why I think Interactive Brokers (IBKR) is the best broker in Singapore.

These reasons include super low commissions, spot FX rates, fractional shares support, free FX transfers, and more.

Now, you’re probably excited to open an account and start investing with them.

However, you might run into some problems.

There is a general consensus that IBKR’s platform isn’t as user-friendly as what you might be used to, especially if you’re switching over from Tiger Brokers/Moomoo.

I personally think it’s not that bad, but I can see where they’re coming from.

In particular, the funding instructions for performing a wire transfer appears to be more complicated than it actually is, which is why I’m writing this post.

Other than that, I’ll also be touching on some things that I think you should know about IBKR before you start investing with them.

How To Fund Account

For IBKR, funding your account is done via wire transfer.

This is not as convenient as Tiger Brokers or Moomoo where they allow you to fund your account via DDA, and IBKR makes it more complex by providing you with information you don’t really need.

The easiest way to perform a wire transfer into IBKR is via a DBS account because IBKR uses a corporate DBS account.

The best account to use is the Multiplier account because it is both a multi-currency account (MCA) and a good savings account.

If you don’t have a DBS account, I’d recommend that you open a Multiplier account!

IBKR allows you to fund your account in 5 different currencies, namely: SGD, USD, HKD, CNH, and GBP.

The funding instructions are the same regardless of the currency you want to fund your account in, except for the currency you specify.

Note: funding in FX is only free if you use a DBS account – if you use other bank accounts, applicable fees may be charged to you.

Now, let’s get into the steps of how to fund your account. For this example, I will be depositing USD using my DBS Multiplier account.

There are 2 parts to funding your account.

First, you need to initiate a transfer on IBKR to inform them that you intend to fund your account.

Second, you need to perform the transfer on your DBS account.

1: Initiate Transfer

Step 1.1

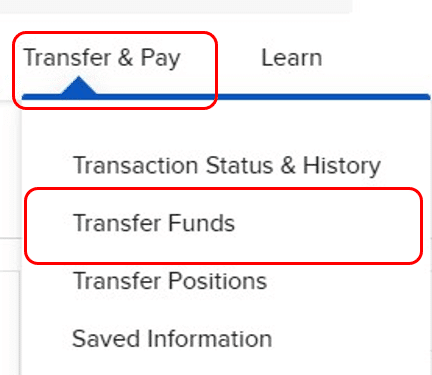

Login to the IBKR online portal and navigate to “Transfer & Pay” > “Transfer Funds“, then click “Make a Deposit“.

Step 1.2

From the dropdown menu, select the currency you want to fund your account with, then click on “Get Instructions“.

Step 1.3

Choose “Yes” for transferring funds from DBS.

Enter an account nickname, which is what IBKR will save as the name for this type of transfer, so you should choose an intuitive name for future transfers like “DBS – USD”.

Enter your deposit amount. Note that this should be the amount as denoted in your specified currency.

Then, move on to the next step.

Step 1.4

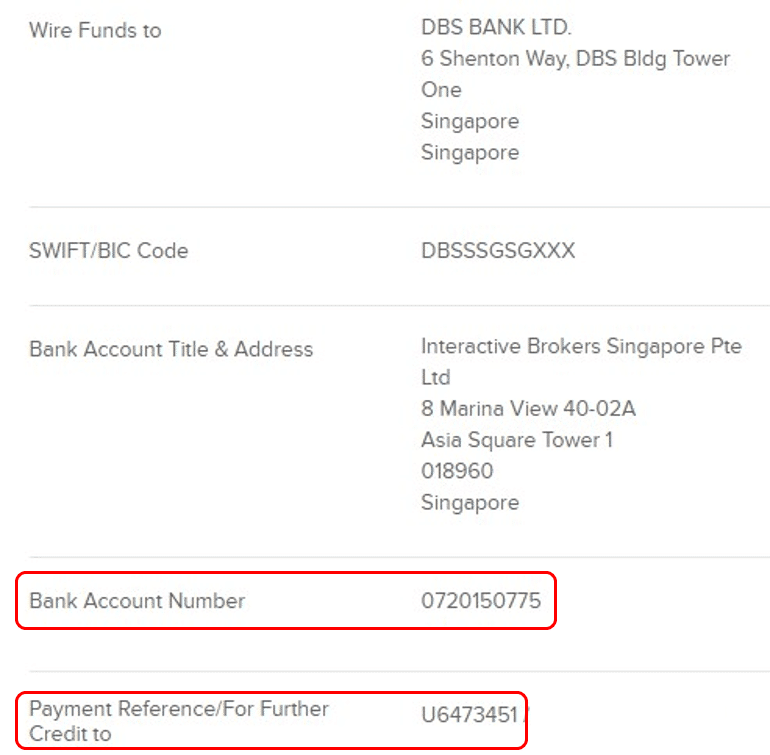

You get presented with a lot of information here, which is where it gets confusing.

The only things you need to take note of are IBKR’s bank account number and your IBKR account number.

Next, we move on to the 2nd part of the funding process.

2: Add Payee & Make Transfer

Step 2.1

Login to DBS iBanking and navigate to “Transfer” > “Add New DBS or POSB Recipient“.

Step 2.2

Enter the recipient’s name as what you want it to be saved as in your records.

Then, enter IBKR’s bank account number from Step 1.4, click “Next“, and complete the add payee process.

Step 2.3

After you have added IBKR as a payee, from iBanking, navigate to “Transfer” > “To Other DBS or POSB Account“.

Step 2.4

Select the IBKR account you just added as the recipient. It should be a DBS Corporate Multi-Currency Account.

Select the account you wish to make the transfer from.

Make sure you specify that the currency in all cases is the currency you specified in your request when you initiated the transfer on IBKR from Step 1.2. In this example, it is USD.

Finally, in the comments, enter your IBKR account number from Step 1.4 and complete the transfer.

After completing the transfer, it takes about 1 working day for IBKR to receive the funds in your account.

Fixed VS Tiered Pricing

Aside from funding your account, you also need to take note of your account’s pricing plan.

IBKR has 2 pricing plans – fixed pricing and tiered pricing.

In order to enjoy the low commission rates that IBKR is known for, you need to make sure your account is on tiered pricing.

However, by default, all IBKR accounts are opened under the fixed pricing plan.

Quite a sneaky move on IBKR’s part if you ask me.

If you weren’t aware of this and jumped straight into placing trades, you would’ve noticed that the commission you’re being charged is higher than expected.

For reference, below is a table summarising the fees for both fixed and tiered pricing.

| Tiered | Fixed | |

| SG | 0.08%, min 2.50 SGD | 0.08%, min 2.50 SGD |

| HK | 0.05%, min 12 HKD | 0.08%, min 18 HKD |

| US | 0.0035 USD/share, min 0.35 USD |

0.005 USD/share, min 1 USD |

| AU | 0.08%, min 5 AUD | 0.08%, min 6 AUD |

| UK | 0.05%, min 1 GBP | 0.10%, min 4 GBP |

As you can see, fixed pricing is more expensive for almost every market except SG, which is equal.

Logically, you would only want to use tiered pricing, though you’re free to change between the 2 plans.

How To Get Tiered Pricing Plan

Step 1

Login to the IBKR online portal, click on the user icon in the top right corner, then click on “Manage Account“.

Step 2

Scroll down to “Configuration“. You will see whether you are under the fixed or tiered plan under “IBKR Pricing Plan“.

If you want to change this, click on the Settings icon.

Step 3

In the table, choose Tiered pricing and click “Continue“.

Your pricing plan is now successfully changed!

Note: It will take up to 1 working day for this change to be implemented in your account.

To check whether this change has taken effect, when placing a trade, make sure you preview the costs and see that you’re not being charged the fixed pricing for commissions.

Margin VS Cash Account

Finally, you also need to pay attention to the type of account that you have – whether it is margin or cash.

A margin account is an account that allows you to borrow cash to make investments, like taking out a loan from the broker.

This cash needs to be repaid and will accrue interest if repayment is not made in due time.

This means that even if you have insufficient cash in your account for an investment, you can still execute the trade on margin.

Meanwhile, a cash account does not allow you to borrow cash, so any trades that you execute need to be settled with existing cash in your account.

Having a cash account is safer is because it prevents you from making unintentional margin trades which can become expensive in terms of the accrued interest especially if you don’t know that you have placed a trade on margin.

You are given the option to choose between a margin and cash account during the account creation process.

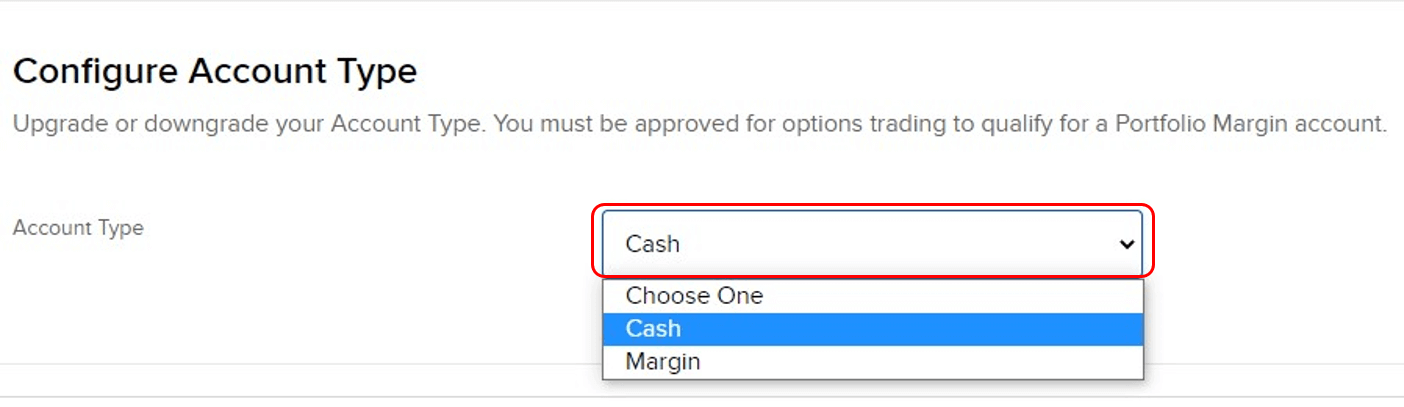

However, if you accidentally made the wrong selection or don’t know which you are using, you can check and change the type of account you have by following the steps below.

How To Check/Change Account Type

Step 1

Login to the IBKR online portal, click on the user icon in the top right corner, then click on “Manage Account“.

Step 2

Scroll down to “Configuration“. You will see whether you are using a Cash or Margin account under “Account Type“.

If you want to change this, click on the Settings icon.

Step 3

From the dropdown menu, select “Cash” as the account type, then click “Continue“.

Closing Thoughts

Even though there are some things about IBKR that may not be so intuitive, once you get the hang of it, it’s not a big deal anymore.

Personally, I find the funding instructions confusing with all the details they give you, so I decided to base this post around it.

But after finding out how to do it once, it becomes much simpler.

Another 2 things that I think are important to take note of are your account type and pricing plan, which is why I decided to supplement this post with this information.

Hopefully, this post has saved you from struggling to find out all this important information about IBKR. If so, share it with someone who’s new to IBKR to return the favour!

If you’re not already doing so, I’d definitely recommend you to start using IBKR.

If you’re looking to open a new IBKR account and need a referral link, feel free to drop me an email – you’ll receive IBKR shares as a reward, and it goes a long way in supporting me to maintain this blog!

What else do you find unintuitive about IBKR? Let me know in the comments below!

38 replies on “Interactive Brokers Guide: How To Fund Account With Foreign Currency & More”

Hi Frugal Student! I stumbled across your website through seedly recently! I just spent a good hour reading through your website and it’s super awesome! Thank you so much for all these valuable insights will definitely be switching to Interactive Brokers. Looking forward to more content from you.

Hi Rei,

Thanks for checking out my blog and for the kind words! Glad that you’ve enjoyed the content and found it useful. I’ll continue to post regularly, so do drop by the blog every now and then! 🙂

Hi Frugal Student, thanks for the good read!

Just a question, may I wonder why did you choose to deposit USD instead of SGD into the account? Will there be any difference if I choose to deposit SGD and convert it to USD within the app itself?

Thank you!

Hi Robert,

Thanks for checking out my blog and leaving a comment!

I didn’t explicitly state this in the post, but the reason I funded my IBKR account with USD is that I was moving my investments from Tiger Brokers to IBKR. Selling off my investments in Tiger Brokers meant that I had my cash in USD rather than SGD (as people typically would from their savings/salary). To avoid FX losses, I decided to fund my IBKR account with USD directly.

Subsequently, though, I do fund my IBKR account with SGD and convert it to USD in IBKR as required. Do note that FX conversions on IBKR come at a fee of 2 USD, but the FX rates you get are better than you’d find anywhere else.

Hope this helps!

Hi Frugal Student,

Thanks for the clarifications!

Noted on the FX conversion rate of 2 USD, I guess it will be much more cost efficient to convert more SGD to USD at once!

Indeed! If you convert SGD to USD frequently and at small sums, the 2 USD fee racks up quickly. If you need to convert a small amount of SGD to USD, it may be a better idea to convert your SGD to USD in DBS and then transfer USD directly into IBKR – FX rates have less impact when the conversion amount is small.

I just opened ibkr account using your referral link, thanks. Now, my base currency is USD. However, I funded the account in SGD, but I do see the the usd equivalent amount available, so am I still required to convert currency to usd? Looking at cspx btw…

Hi Brandon,

Thanks for the support, I really appreciate it! Glad to hear from you again 🙂

Yes, you do still need to convert currency from SGD to USD before you make trades for USD-denominated stocks/ETFs. Having the base currency in USD simply means that the figures you see (ie account value) are displayed in terms of USD rather than SGD. But since you funded your account in SGD, the cash you own in your account is in SGD, even if the amount is shown in terms of USD.

Hope this clarifies things!

Hi there,

Thanks for the informative posts.

Would like to open an account with IBKR , could you provide the link to my email?

Do you have a list of Ireland domicile ETF included China ETF? Your comments/recommendation if any.

Truly appreciated.

Hi Dawn,

Thanks for checking out my blog and leaving a comment!

I’ve responded to you via email 🙂

Hi, thank you for replying and providing such good insight. I’m planning to do the same by moving my Tiger investments to IBKR and stumbled upon your post while trying to find more info. Did it cost anything to transfer the USD to DBS MCA? Thank you!

Hey Elle,

Thanks for checking out my blog and leaving a comment – I’m glad you’ve found my posts helpful!

Withdrawing USD from your Tiger Brokers account directly into your DBS Multiplier account will not cost any fees. You can see this from Tiger Brokers’ website:

https://www.tigerbrokers.com.sg/help/detail/funds-withdrawal#:~:text=Withdrawal%20Process%20Request,Profile%20%3E%20Tiger%20Account%20%3E%20Withdrawal.

Then, you will be able to fund your IBKR SG account in USD from your DBS Multiplier account, again with no fees.

Hope this helps!

Hi,

May I know if we can withdraw USD from IBKR to DBS MCA account? Is there any fee?

Regards,

Lam

Hi Lam,

Thanks for checking out my blog and leaving a comment!

You’re able to withdraw USD from IBKR to DBS MCA, but there is a telegraphic transfer fee that is applicable on DBS’s side (~$10). This fee is waived for DBS Treasures members, I believe.

Hi, just wanna say thank you for this. It’s very easy to understand and has helped me.

Hi Mel,

Thanks for the kind words! It means a lot. Glad you’ve found my content helpful 🙂

Interesting and helpful post! Regarding the margin and cash account point that you’ve mentioned, have you tried executing option trades on a margin account? Because option is leveraged product, so just wondering if IB charge a daily fee when the option position is open?

Hey AA,

Thanks for checking out my blog and leaving a comment! I’m writing this email to give you my response.

Unfortunately, I’m not able to share more regarding option trading on IBKR because I don’t use options myself – sorry! But from what I understand, you should be charged an interest rate for opening a margin position – ie the cost of borrowing. As for the actual fees you incur for the options contract itself, I’m afraid I don’t know enough about it to share further.

Hi there, I’m an avid reader of your blog and thanks for helping me getting started on my investing journey.

Today, I followed your instructions as per this article but IBKR is showing me information to transfer to their CITIBANK NEW YORK account instead of DBS.

Am I doing something wrong here?

Hey Lim,

Thanks for checking out my blog and leaving a comment! I’m glad you’ve enjoyed the content so far and found them helpful 🙂

If you’re being asked to send funds to their North America bank account, it’s possible that you have an IBKR LLC account instead of an IBKR SG account.

You can check this by going to your activity statements – at the top, it will either say ‘Interactive Brokers Singapore’ or ‘Interactive Brokers LLC’. From the mobile app, you can go to ‘More’ > ‘Account Management’ > ‘Activity Statements’ > ‘Run’.

Hope this helps!

Hi, the Frugal Student!

Love your content and your simple and clear writing. Thank you so much for everything you put out there.

I tried to send you an email using the link above but it bounced back. Could you send me an email including your referral link to open an IBKR -SG account? Thank you very much!

Hi Lauren,

Thanks for checking out my blog and for leaving a comment! I’m glad you’ve found my content helpful 🙂

As requested, I’ve dropped you an email with my referral. Thanks for wanting to support me and the kind words, it means a lot!

Cheers!

Hi, the Frugal Student!

Option A: Transfer SGD (DBS My Account) –> to IBKR SG account –> convert the transferred sum to USD

Option B: Convert SGD to USD using Wise –> deposit USD to DBS My Account –> transfer USD to IBKR SG account

Which option is more cost-efficient? Appreciate your advice.

Hey CKY,

Thanks for checking out my blog and for leaving a comment!

To my understanding, the fees incurred in option A will be 2 USD, charged by IBKR.

Meanwhile, in option B, the fees incurred will be an FX handling fee of 10 SGD, charged by DBS (waived for Treasures/Priority Banking customers).

Based on this, it’s probably cheaper to go with option A. Hope this helps!

Hi, the Frugal Student!

I’m a Malaysian, can we open IBKR SG account? If yes, what’s the best way to go about it? If I have a HSBC premier MCA account in Msia. does it help?

Hey Quek,

Thanks for checking out my blog and leaving a comment!

I’m not sure if IBKR SG accounts can be opened by non-SG residents, but even if you can’t open an IBKR SG account, you’ll probably be able to open an IBKR account of another sort, which should be pretty much the same as an IBKR SG account. If you want to specifically open an IBKR SG account, perhaps you can try signing up via an IBKR SG referral link – though I’m not sure if this guarantees you’ll open an IBKR SG account.

Hope this helps!

Hello! This was very helpful! Thank you so much haha!

I just wonder, is there a way I could still use your referral code or something because I just opened an IB account before I stumbled on your post to seek help about what’s the best way to fund the IB account with USD HAHAHAH

Best,

Natasha

Hey Natasha,

Thanks for checking out my blog and for leaving a comment! I’m glad you found my post helpful.

Unfortunately, I don’t think there’s any way to enter a referral code after your account has already been created. Thank you for wanting to support me though, it means a lot!

Hope this helps & all the best!

Hi! What is the fee that Interactive charged you for funding your account in USD? Or is there no wiring fee? thank u!

Hey J,

Thanks for checking out my blog and leaving a comment!

If you fund your IBKR SG account in USD via bank transfer using a DBS multicurrency account, there is no fee – this is because IBKR SG also uses a DBS multicurrency account.

If you do so with a different bank account, or if you are using IBKR LLC, then other charges may be liable.

Hope this helps!

Hi, the frugal student,

Thank you very much for so much useful informations that you have shared on this page.

I am a newbie to IBKR, just opened account some days ago after using TigerBroker for more than a year. I want to move some of my Tiger investment into IBKR using USD deposit from my DBS multiplier account ( to save the conversion fees) like you did. Please help me to clarify if I should apply to open My Account (where you can get access to foreign currencies) via DBS Ibanking? Or can I transfer the USD from Tiger into my multiplier account directly? Before I also had to apply to open an Emysavings account for its auto deductions every month.

Please support.

Thank you very much.

Hey Michelle,

Thanks for checking out my blog and leaving a comment – I’m glad you’ve found my posts helpful!

If you already have a Multiplier account, there’s no need to apply for a My Account – the Multiplier account already functions as a multi-currency account, so it will be able to hold USD.

You will be able to withdraw USD from your Tiger Brokers account directly into your DBS Multiplier account with no fees.

Then, you will be able to fund your IBKR SG account in USD from your DBS Multiplier account, again with no fees.

Hope this helps!

Hi The Frugal Student,

Thank you for your information, I saw your blog after registering with IBKR however, I am still waiting for approval even though it has been funded and after two weeks, I am stuck at the application status page saying.. ”

We’ve submitted your application for approval.

Your account application is pending approval.”

What shall I do at this point? I have submitted it as required.

Thank you very much.

John

Hey John,

Thanks for checking out my blog and for leaving a comment! I’m writing this email to give my response.

That’s strange, I haven’t encountered a situation where it took so long for an account application to get approved.

I’d recommend contacting IBKR’s customer support as they’re most likely to be able to help you with this – sorry I can’t be of more help!

Hi TFS! You hv done a great service with your clear n well-written explanations. My question: I have a Syfe Trade account buying n selling US stocks in USD. If i transfer USD proceeds from Syfe Trade to DBS. Multi currency Myaccount, wld there b any changes or fees? Many thanks. Moh

Hey Mohamed,

Thanks for checking out my blog and for leaving a comment!

While I haven’t tried withdrawing USD from Syfe Trade to my DBS Multiplier account, I believe that there will be fees. To my knowledge, USD transfers within SG are usually done via telegraphic transfer, for which the fee I was charged previously on a different platform was $10.

Depending on how much USD you are withdrawing, this might be better or worse than converting it to SGD before making your withdrawal.

Hope this helps!

Hi, I am glad I have found your blog. This is quite helpful. I just transferred a little bit USD (for testing) from My Account DBS to my new opened ibkr account. When I want to add new payee in DBS with the acc no which ibkr provided in instruction apparently it is not DBS multi currency account but a regular account. So when I saw my balance in ibkr it got deducted by 0.73% (rate today?). I wonder don’t ibkr has DBS multi currency any more? I have already specified that I will transfer in USD. Many thanks.

Hey Melly,

Thanks for checking out my blog and for leaving a comment! I’m glad you’ve found my posts helpful.

To my knowledge, IBKR’s DBS account is a multi-currency account – it is still reflected as so in my Payee list, and their bank account hasn’t changed, though I haven’t made a USD deposit into IBKR since a few years ago..

A fee of 0.73% seems to imply that DBS did some currency conversion on their end before completing the transfer (as DBS’s currency conversion rate is usually ~0.7% worse than the market rate).

Here are some things you can check regarding your transfer:

1. Did you specify to make the deposit from your USD wallet in your DBS account?

2. Did you specify to make the deposit into the USD wallet in IBKR’s DBS account?

3. Did you receive the funds in SGD or USD in your IBKR account?

If you believe you did everything correctly, it might be better to check with DBS’s customer service regarding the transfer rate.

Hope this helps!